Financing Sustainable Urban Development

When it comes to implementing sustainable development in cities, the question of financing is usually on if the biggest obstacles. Therefore, on the 14th of October, the MGI Webinar Smart City Financing and Procurement took place. Five international speakers shared their expertise on how to obtain funding for sustainable urban transformation.

The goal of the MGI webinar series is to share expertise in the field of climate change mitigation and adaptation with city planners, city administrators, and professionals involved in urban development in general. The webinar was the sixth and last of this series and was moderated by finance expert Maria Jesus Baez from the Frankfurt School of Finance & Management.

Bringing businesses on board for climate protection and climate resilience

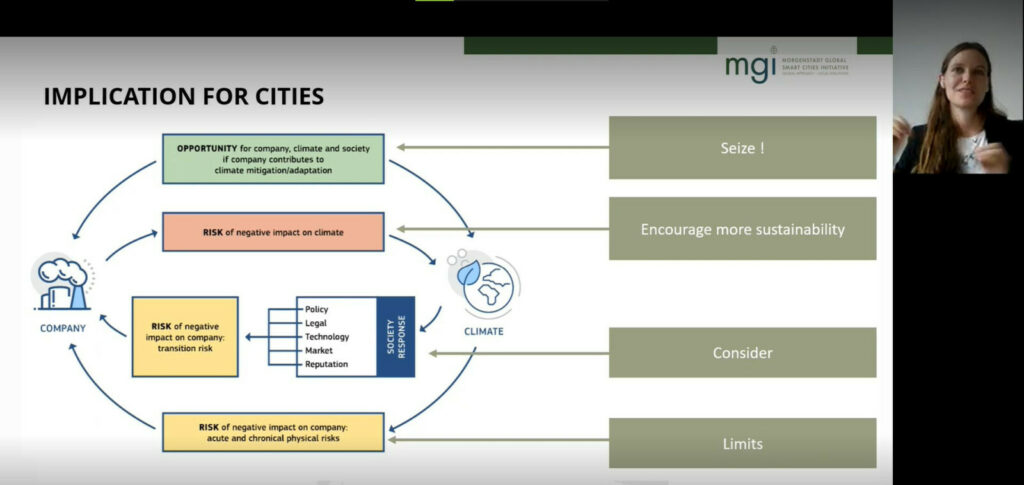

Mathilde Bossut from the Frankfurt School Unit Center gave a presentation on the intertwined relationship between economy, cities, and climate change, highlighting that cities and business go hand in hand when it comes to sustainability.

She stressed that it is of vital importance that cities and businesses work together when it comes to climate change adaption and mitigation. For instance, identifying risks and developing a sustainability or resilience strategy together with local businesses. Room for dialogue and knowledge sharing is fundamental.

She also pointed out the opportunity for cities to receive funding from the green economy sector by making investing in climate change adaption and mitigation attractive for those businesses. Mathilde closed by sharing further material on how to foster city-business-collaborations.

Overcoming financing barriers for sustainable urban development

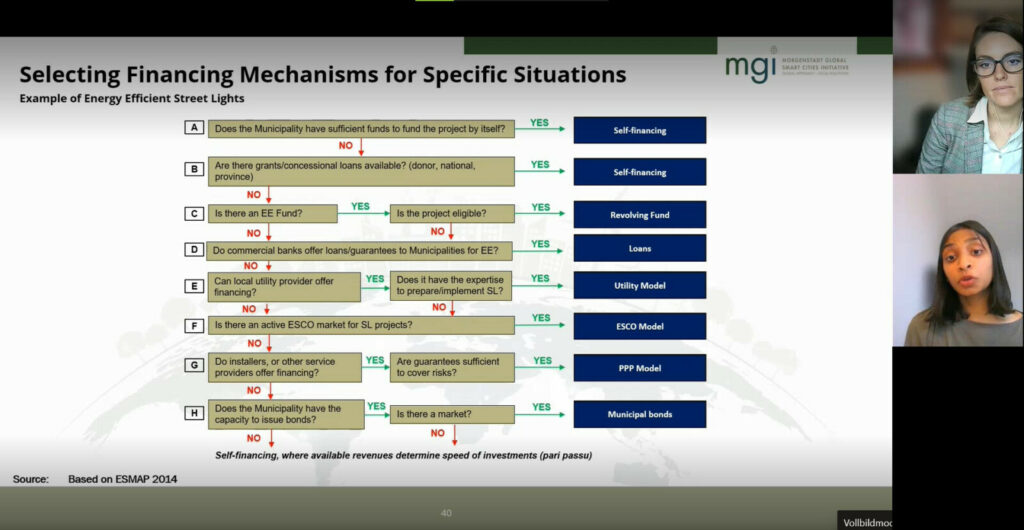

Sustainability consultant Gabrielle Carbonell and Yamini Jain from the Frankfurt School Unit Center illustrated how to overcome financing barriers in different areas of sustainable urban development at the example of the MGI pilot cities Saltillo, Piura, and Kochi. Such barriers might be capital intensive implementations and the lack of public recourses to finance those.

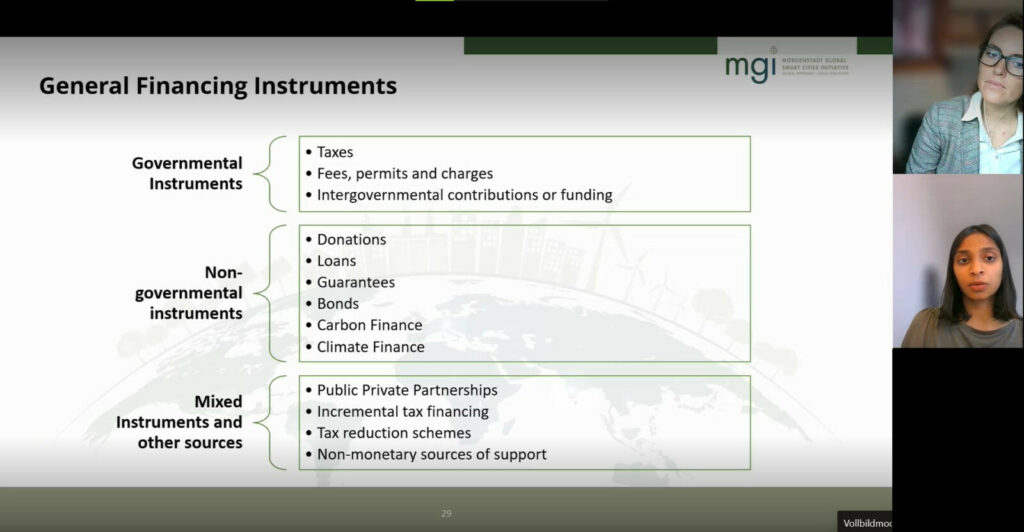

Generally, financing instruments can be found in the government sector, in the non-governmental area, and through other sources such as non-monetary support or the partnerships between the public and private sector. The latter would be most relevant when high investments are needed.

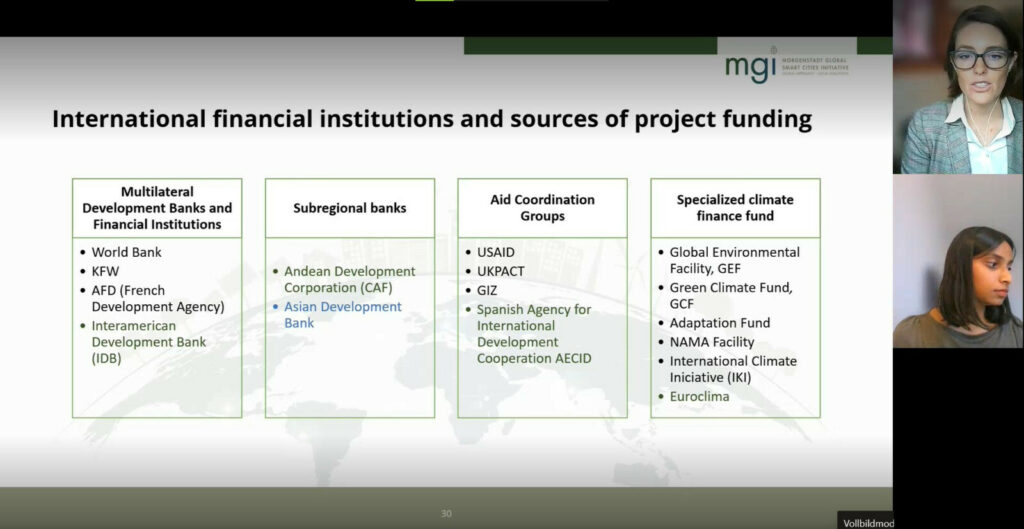

Yamini pointed out that especially carbon and climate financing are becoming more and more relevant considering the urgency of climate change adaption. Also, international instances can offer a recoverable and non-recoverable source of funding.

Gabrielle highlighted that those institutions have a wide offer of financial mechanisms, ranging from loans to technical assistance and advising on municipal, national, and private sector level.

Additionally, the experts presented public sources and possible financing instruments by sectors specifically for projects in Mexico, Peru, and Kochi. They closed with a framework for selecting the right financing mechanism for each project.

The selection framework for financing mechanisms.

René Castro Salazar from the Food and Agricultural Organization of the United Nations opendes his presentation highlighting the urgentness of the worldwide climatic situation and the neccesity to act immediately as a international community to reduce CO2-emmissions.

Micro and macro actions to fight climate change

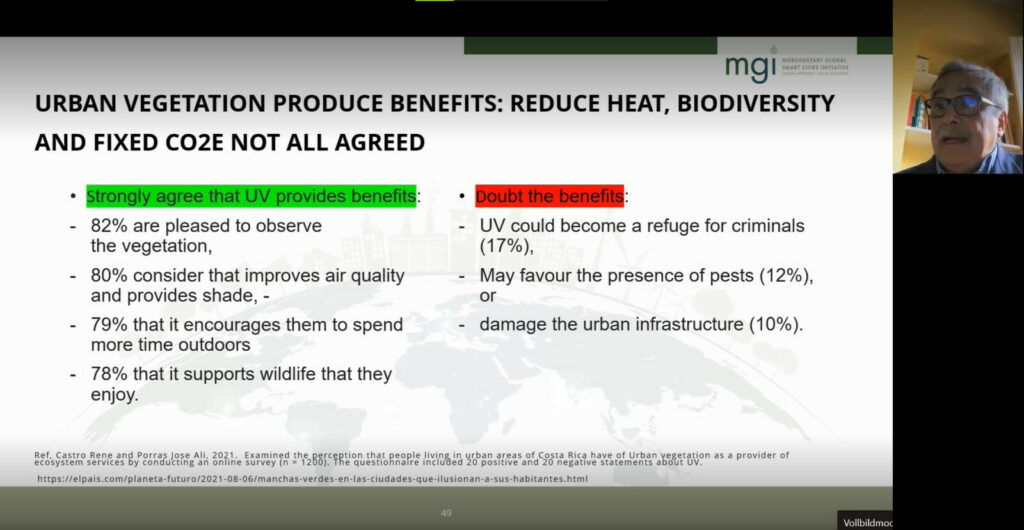

On farm level, Rene presented as a best practice example a low carbon coffee initiative in Costa Rica and a livestock production in Brazil that reached CO2 neutrality by changing their modes of production. For the city level, he gave the example of a survey about implementing green patches in urban areas to reduce heat and CO2 and conserve the biodiversity. Rene stressed that the majority of the questioned perceived the measure and its impact as positive.

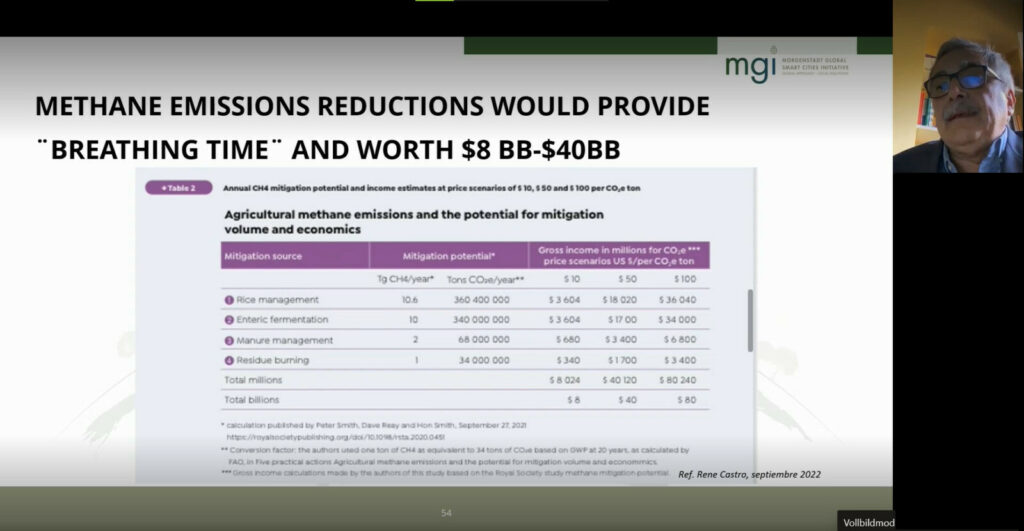

He also demonstrated that on the short term, reducing methane emissions dramatically would have an immediate impact on stopping global temperature rise, as well as generating a monetary flow towards rural areas. CO2 trade also was an important short-term measure. Rene closed by making clear the disastrous outcome if global warming is not stopped, namely climatic crisis and migration crisis.

Using green and social bonds to finance sustainable transformation projects

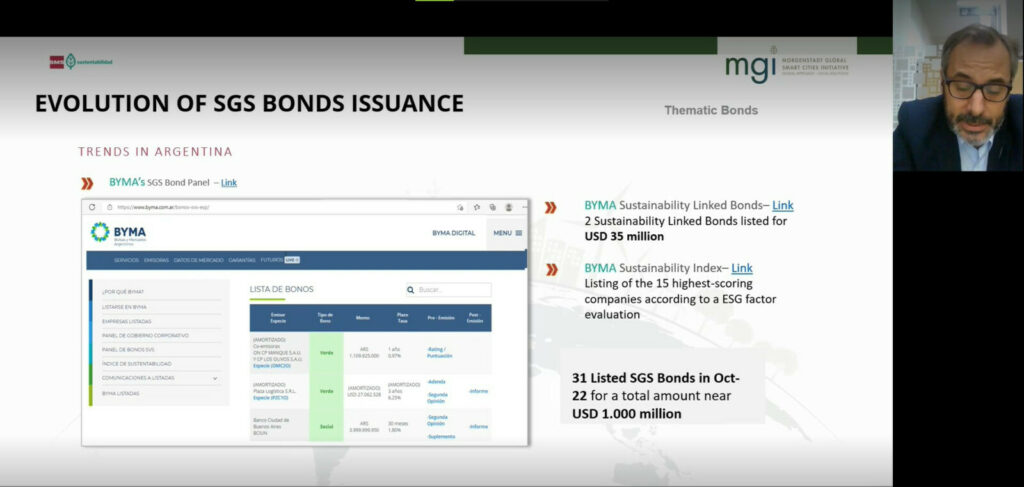

In his contribution, Julián Constabile from SMS Sustainability pointed out the potential for cities using green and social bonds to finance sustainability and climate change adaptions measures. According to Julián, such bonds are fast growing financial instruments in Latin America with more and more governments and companies investing.

Cities frequently make investments that can be classified as green or social investments. However, in Latin America, there has not been a wide usage of the bonds to finance green investment project in cities. Therefore, green and social bonds are a growing source of funding and a huge opportunity for cities to better finance these investments.

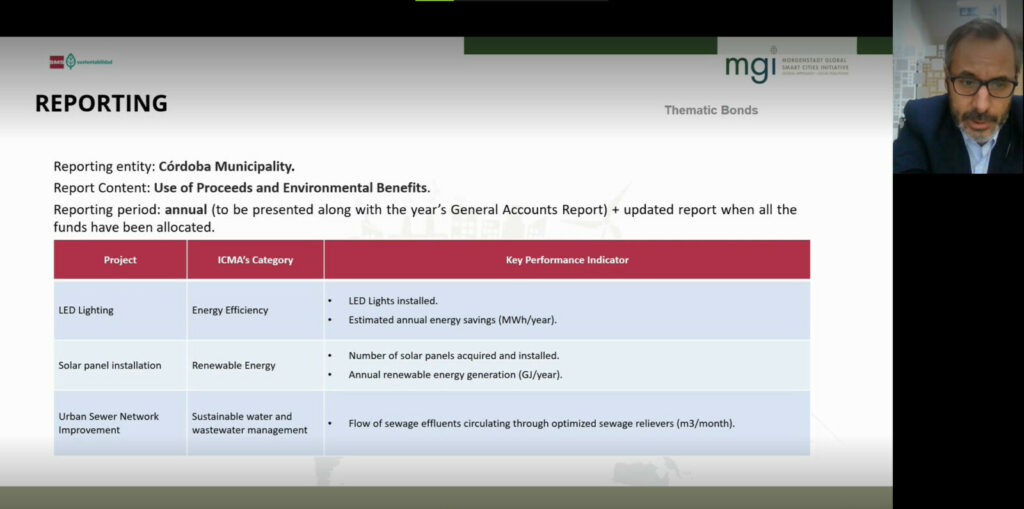

Closing his presentation, Julián stressed that when issuing a bond, it is crucial to have a clear KPI of the implementation measures, so that the investors know what the outcome of their investment will be. He concludes that bonds are an important tool to finance climate change mitigation and adaptation projects in sectors such as waste management, water management, transport, and energy efficiency.

Would you like to know more about each topic? Here you can download the presentation slides in English.

Share this report with your network!

Facebook

Twitter

LinkedIn

Email